ev charger tax credit form

The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation. Form 2848 Power of Attorney.

Electric Vehicle Tax Credits On Irs Form 8936 Youtube

Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of.

. For residential installations the IRS caps the tax credit at 1000. This is a one-time. In its current form the solar energy tax credit in the Inflation Reduction Act applies.

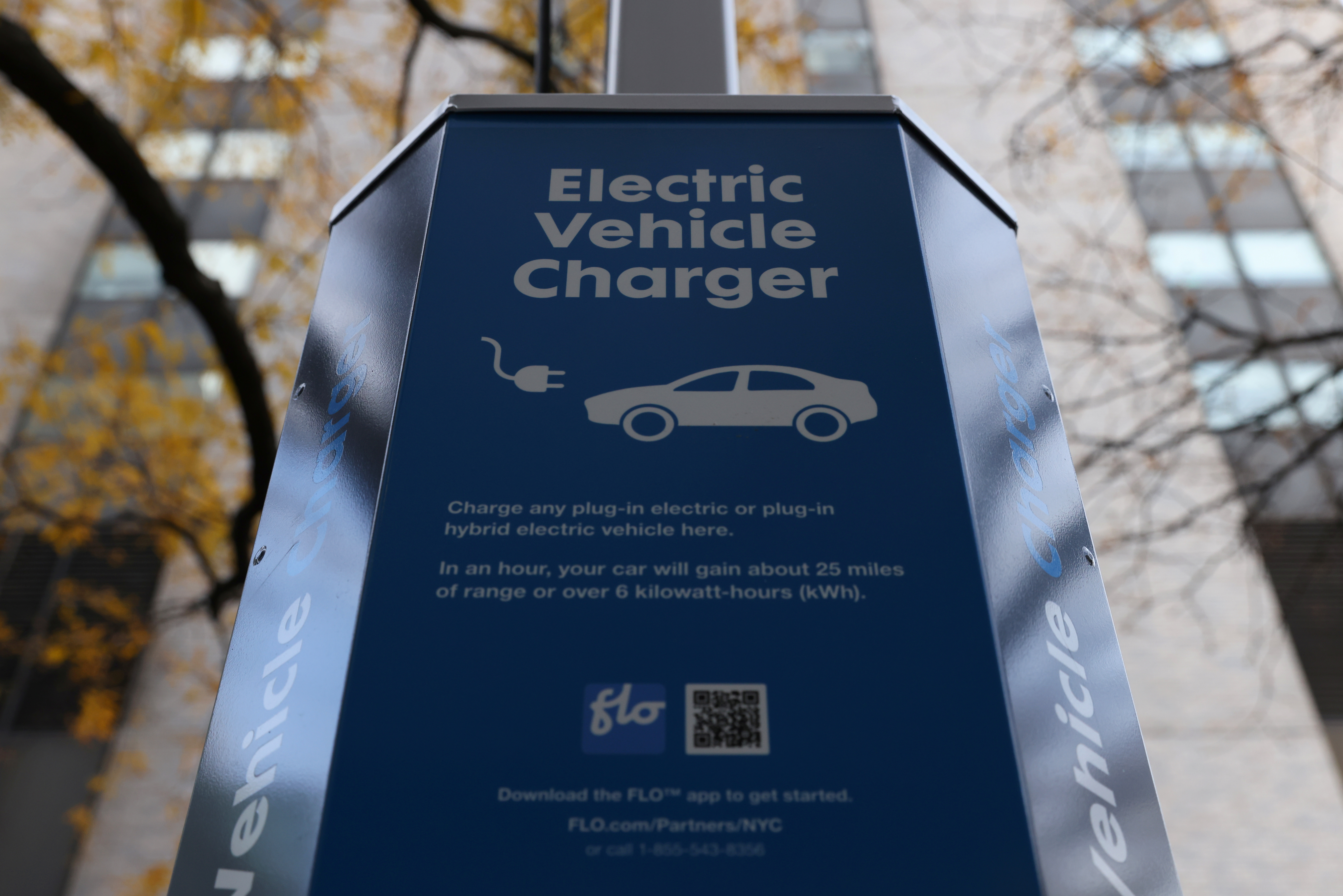

Overall the program didnt change much from its short death and the changes will benefit Americans. Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in their homes after December 31 2021. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs.

If your looking for Other Business Services in Piscataway New Jersey - check out Tax Credits LLC. The EV charger tax credit program will now continue until 2032. Tax Credits LLC is located at 45 Knightsbridge Road 22 Piscataway NJ 08854.

This incentive covers 30. Incentives depend on the HERS score and the classification. The filing of this.

Thats why we have a dedicated customer service phone line just for you. NJ Clean Energy- Residential New Construction Program. If youre one of our business customers we know that you sometimes have very specific needs.

The federal tax credit for electric vehicle chargers originally expired on December 31 2021. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. This form is used to grant an licensed tax professional authority to speak to the Internal Revenue Service on behalf of an individual or business.

In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial. Federal EV Charging Tax Credit.

The Definitive Ev Tax Credit Guide

Where Do I Enter Electric Vehicle Charging Station Installation Intuit Accountants Community

Federal Tax Credit For Ev Chargers Renewed

Electric Vehicle Tax Credits What You Need To Know Primecomtech

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Up To 1k Tax Credit For Ev Home Charging Station R Boltev

Ev Charger Federal Tax Credit Is Back Kiplinger

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

How Do Electric Car Tax Credits Work Credit Karma

How Do Electric Car Tax Credits Work Kelley Blue Book

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

How To Claim An Electric Vehicle Tax Credit Enel X

Filing Tax Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Turbotax Tax Tips Videos

California Electric Car Rebate Everything You Need To Know

About Electric Vehicle Charging Efficiency Maine

South Korea Presses Concerns Over U S Ev Tax Credit Reform Reuters

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Ev Provisions In The Inflation Reduction Act Protect Our National Security The Hill